Inflation & A Recession In 2023 Is Coming, Are You Prepared?

Listen, I wish I had better news to share with you, but it’s true. The recession is coming. There is even experts saying there is a “100% chance the US enters a recession by mid 2023. That on top of insane inflation numbers, has many worried, and for good reason.

But what if I told you there are ways to protect yourself, your assets, and even make money during these crazy times of super high inflation and recession fears.

In fact there are a few ways. But, when it comes to inflation or a recession, there is no better option and protection than having Gold.

We don’t want to beat around the bush. We’ll explain below why gold is the best inflation hedge and asset to hold during a recession, but in the meantime, we want you to grab the completely free Gold kit below. Click the big button below and grab the free kit

Hedge Against The Recession Of 2023 – How To Prepare

The truth is, Gold has been a historical hedge asset tool. The reason being is Gold is a store of value with a fixed supply that can be used defensively. Gold is a popular choice among investors as a recession hedge because it is “recession-proof” and does not directly correlate with the stock market.

Think about it, the government keeps printing trillions of dollars every single month. whether it’s for an act they pass, for Ukraine, or anything else. The printing does not stop. With gold, there is no printing, there is a fixed supply (amount.)

Inflation Hedge

But what about inflation? Will gold be beneficial during these times of crazy high inflation?

According to some studies, gold can serve as a reliable inflation hedge, especially when holding for longer periods of time. Researchers discovered that the inflation-adjusted price of gold changes significantly over shorter time frames.

This means that gold will probably cost more if the value of the dollar declines as a result of inflation.

In difficult economic times, investors look to gold as a store of value, and many view it as a substitute currency.

Gold Price In The 2008 Recession & Other Recessions

From March 2001 to November 2001, was the time of the Dot-com recession, that lasted 8 months. Gold’s performance during this moderate-length recession was the opposite of the S&P 500’s. As stocks tumbled over 50%, gold remained strong. In addition to stock losses, many other asset-based investment losses could have been mitigated by purchasing gold.

From December 2007 to June 2009, the Great Recession lasted much longer than expected. Gold experienced some volatility during this time, but it also increased while the S&P 500 fell by 54%. One more time, having gold in your portfolio would have more than offset other losses, and allowed you peace of mind.

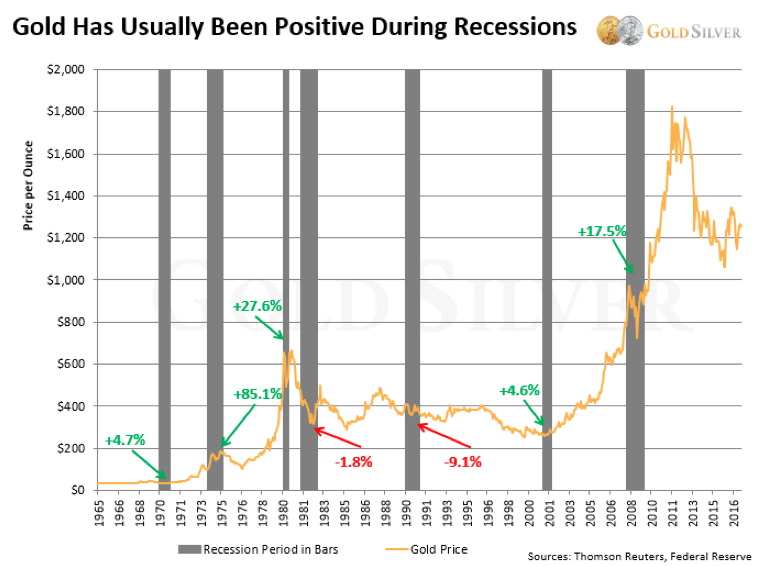

Recession and Gold Prices Via Chart Breakdown

The price of gold increased from the beginning of the recession to the end in five of the seven recent ones. Only one of the declines—a loss of 9.1% in 1990—was appreciably different. In contrast to all the other recessionary periods, gold essentially increased during the 1982 recession.

Even in the midst of the 2008–2009 financial crisis, the price of gold eventually increased. Yes, it initially declined when the crisis first began in October 2008—more so due to the need for liquidity than anything else—but it quickly recovered and was 17.5% higher by the time the recession came to an end.

While specific economic circumstances during recessions can change, historically gold has performed favorably more often than not.

Best Way & Types Of Gold

When it comes to the best way to hold Gold in your portfolio, we recommend a Gold IRA. There are so many benefits to this and we’ll explain them here:

- You are in charge of your own actual, non-paper precious metals assets.

- Take advantage of exclusive tax-advantaged savings.

- Enhance the special benefits of alternative assets: actual gold and silver

- Stay away from traditional banking and digital systems’ unreliable security.

With time-tested assets that have never lost value, diversify your savings and enjoy peace of mind. Not only that, but in case the Federal Reserve’s monetary policies result in the dollar being devalued, protecting yourself from inflation could increase your wealth.

With the inherent diversifying qualities of gold and silver, you can seek to lessen the impact of economic unrest on your savings.

Other options include physical gold that is available as bars, ingots, or coins of gold bullion. If you want to stay away from management fees and associated risks, this is a good choice. However, these could get expenses with storage, and selling it might be more difficult or expensive.

What is Augusta Precious Metals?

Augusta Precious Metals is a Gold IRA provider offers a variety of precious metals IRA products to aid customers who want to use precious metals to hedge against inflation risks (or simply diversify their portfolio).

Customers must have at least $50,000 in retirement savings, such as IRAs or 401ks, to begin working with Augusta.

Gold IRAs are a little different than traditional IRAs, and organizations like Augusta Precious Metals have built their businesses around making precious metals IRA onboarding as simple as possible.

Augusta Precocious Metals Gold IRA Info

A amazing reputation for providing the best Gold and Silver IRA options has been established by Augusta. By educating you on the advantages and disadvantages of investing in gold, they will help you right away, even before you begin.

They can help you with 95 percent of the paperwork needed to diversify some of your portfolio into gold, as well as help you figure out how much of an inflation hedge gold can offer for your assets.

In addition to assisting you with the IRA setup, they serve as a liaison between you and the custodian who will actually store and secure your gold. This implies that you can engage with your physical assets however much or little you like.

Customer ratings

We searched the internet for verified Augusta Precious Metals customer reviews, but we could not locate any Augusta Precious Metals complaints at this time.

However, they have a slew of positive reviews from review sites all over the internet.

| Source | Rating |

| Better Business Bureau | A+ |

| Business Consumer Alliance | AAA |

| TrustLink (300 Customer Reviews) | 5/5 stars |

Before investing with any precious metals IRA company, check for customer complaints and reviews.

When conducting due diligence on a company, check out sites like the BBB, BCA, TrustLink, TrustPilot, and Yelp.

Augusta Precious Metals Fees and Pricing

| Augusta Precious Metals Fees | |

|---|---|

| Minimum Purchase Requirements | $50,000+ |

| Startup/Setup Fees | There is a one-time $50 application fee. This includes getting paperwork filed and set up, as well as making sure that gold investing is right for you. |

| Annual Custodian Fees | Many Gold IRA companies aren’t even aware of them. Custodial fees in Augusta are $250 per year for the first year and $100 per year after that. |

| Annual Storage Fees | 100 (This is Covered by Augusta)* |

| Shipping Costs | This is free with a qualifying purchase. Augusta will cover the costs of transporting and insuring your gold during transport on qualified orders, which is something that other Gold IRA companies don’t mention. |

| Markup | 5% (on bullion products) |

Augusta Precious Metals Q&A

How Can I prepare for a recession?

Diversifying. Making sure your portfolio has a mix of many different assets, and absolutely making sure one of them includes gold.

Is Gold good to buy during inflation?

Yes, gold is recommend to buy during times of high inflation due to the fact that there is a fixed amount. Inflation occurs because we are devaluing our dollar. This can come from a number of things, but printing tons of money is usually the main culprit.

Does Gold Go Up During A Recession?

Yes, according to data, gold typically rises during a recession.

Does Gold Go Up During A Recession?

Yes, according to data, gold typically rises during inflation.

Can I Roll My 401k Into a Gold IRA?

Yes, you certainly can. You can even do it without incurring any penalties. Augusta can assist you with all of the necessary paperwork.

Who Should Become An Augusta Precious Metals Customer?

Let’s go over who, in my opinion, should and should become an Augusta Precious Metals customer.

If you want to invest in gold and silver, you should consider an Augusta gold and silver IRA.

- You’re looking into different types of IRAs.

- You’d like to add precious metals to your investment portfolio.

- To get started, you’ll need at least $50,000 in cash.

- You’re concerned about your retirement savings being eroded by hyperinflation.

- You want a company with great reviews and a proven track record, as well as a more white-glove service (hands-on advisor and great customer service)

Conclusion

The recession is coming. Due to our government printing money like there is no tomorrow, we are headed there.

During these uncertain times, it is crucial you are looking out for your money and assets you worked so hard to get.

Gold allows you to protect those assets. As inflation devalues our dollars, and a recession hurts the overall economy, the stock markets will crash, the housing market will drop as people will not be interested in making a huge purchase (and many other reasons.) That leaves your options limited.

Gold not only is a good option here, but according to data it performs exceptionally well during these times.

We highly recommend that you grab the free kit below, and speak to the Augusta team.

They will be able to answer any additional questions you may have, and get you rocking on the right foot!

Want to read more gold reviews? Make sure to check out our gold reviews page here.